Discover FxPro cTrade, a platform meticulously designed for serious traders. It combines robust execution with a rich suite of advanced tools, meticulously crafted to elevate your market strategy. Experience lightning-fast execution and transparent pricing across a vast range of instruments, all operating under true ECN trading conditions. Leverage powerful cBots to automate your strategies, freeing you from constant manual monitoring and enabling round-the-clock market engagement. This is more than just a platform; it’s a complete ecosystem built for peak performance, whether you’re a manual trader seeking precise control or an automated enthusiast. Prepare to take your trading to the next level.

- Understanding FxPro cTrade: An Overview

- Key Features of the cTrader Platform on FxPro

- One-Click Trading Capabilities

- Depth of Market (DoM) Functionality

- Why Choose FxPro for cTrader Trading?

- Getting Started with FxPro cTrader: Account Setup

- Why Choose FxPro cTrader?

- Your Setup Journey: A Step-by-Step Guide

- Documents You Will Need

- Embrace the Power of Automation

- Ready to Begin?

- Navigating the cTrader Interface: A User’s Guide

- Advanced Charting Tools and Indicators in FxPro cTrader

- Unleashing Powerful Charting Tools

- A Wealth of Indicators at Your Fingertips

- Driving Strategy with c Algo Trading

- The Advantage for Every Trader

- Automated Trading with cBots on FxPro cTrader

- Developing Your Own cBots

- Accessing the cTrader Automate Community

- Order Types and Execution on FxPro cTrader

- Mastering Core Order Types

- Advanced Order Management for Precision Trading

- ECN Execution: Speed and Transparency

- Empowering Automated Strategies with cAlgo Trading

- Why Choose FxPro cTrader for Your Execution Needs?

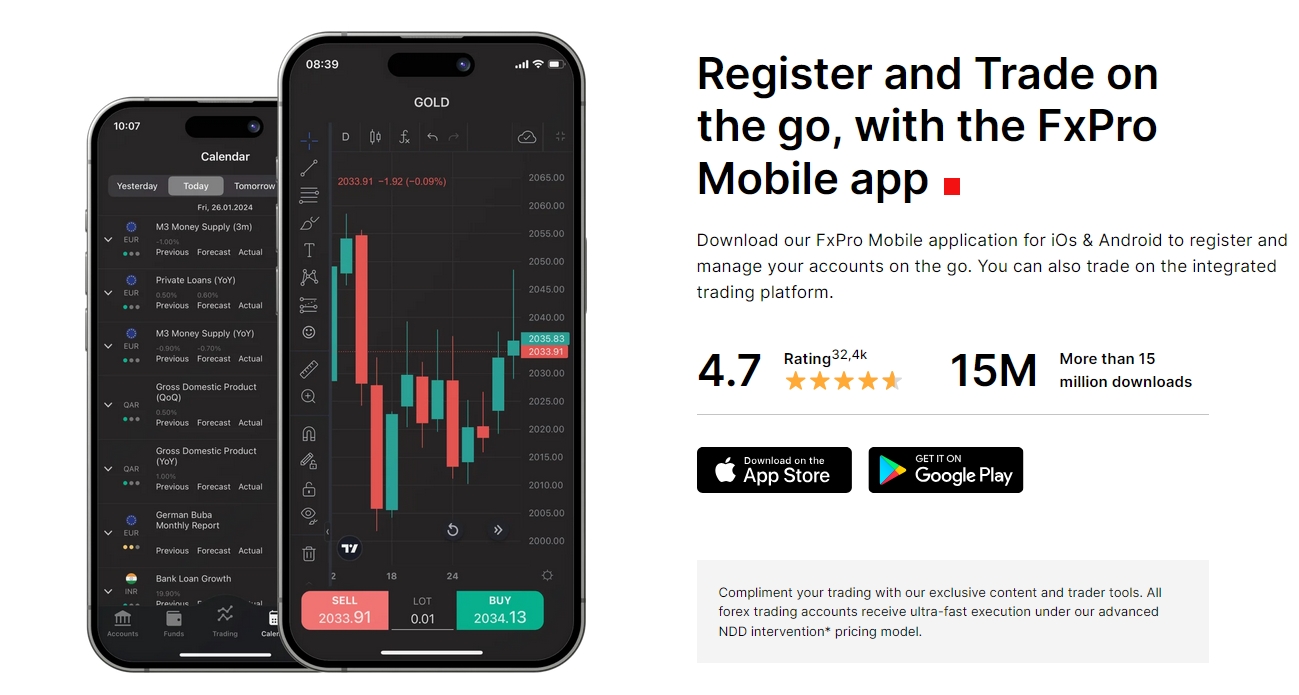

- Mobile Trading Experience with FxPro cTrader Apps

- Spreads, Commissions, and Costs on FxPro cTrade

- Unpacking Spreads on FxPro cTrade

- Commission Structure for FxPro cTrade Accounts

- Other Potential Trading Costs

- Optimizing Costs for Algo Trading Strategies

- Typical Spreads for Popular Instruments

- Commission Structure Explained

- Security and Regulation: Trading with FxPro

- Comparing FxPro cTrader to Other Platforms

- Unrivaled Execution and ECN Trading

- Advanced Automation with cAlgo Trading

- User Experience and Charting Superiority

- A Quick Comparison

- Maximizing Your Trading Potential with FxPro cTrade Strategies

- Harnessing the Power of cAlgo Trading for Automation

- The Edge of ECN Trading with FxPro

- Why FxPro cTrade Stands Apart

- Customer Support and Resources for FxPro cTrader Users

- Direct Assistance Channels

- Empowering Self-Service Resources

- Specialized Support for Algo Trading

- Future Developments and Updates for FxPro cTrade

- Empowering Algo Trading with cAlgo

- Refined Market Access and Execution

- Intuitive User Experience and New Tools

- Frequently Asked Questions

Understanding FxPro cTrade: An Overview

Are you looking for a powerful, intuitive trading environment that truly puts you in control? Dive into the world of FxPro cTrade. We designed this innovative platform for serious traders who demand precision, transparency, and advanced tools. It represents a significant step forward in online trading technology, offering a sophisticated yet user-friendly experience.

FxPro cTrade provides access to a premier trading experience, leveraging the renowned cTrader platform. This means you benefit from ultra-low latency execution and deep liquidity. It’s an environment crafted for efficiency, where every second counts. Whether you’re a seasoned professional or just elevating your trading journey, FxPro cTrade delivers the robust infrastructure you need.

This advanced platform offers a suite of features that empower your trading:

- Transparent ECN Trading: Experience true ECN trading with direct market access, ensuring no dealer intervention and transparent pricing. You see the real market depth.

- Advanced Charting Tools: Access a comprehensive range of indicators, drawing tools, and customizable chart types. Analyze market movements with unparalleled clarity.

- Powerful Algorithmic Trading: Unlock the potential of algo trading. FxPro cTrade supports advanced automated strategies, letting you execute trades based on your predefined rules.

- Customizable Interface: Tailor your workspace to fit your personal trading style. Arrange charts, watchlists, and order panels exactly how you prefer.

For those who prefer systematic approaches, the capabilities for c algo trading within FxPro cTrade are exceptional. Develop, test, and deploy your custom trading robots or “cBots” using C#. This robust framework allows for complex strategy implementation, giving you an edge in fast-moving markets. Its integrated development environment simplifies the creation of automated systems, making sophisticated algo trading accessible.

Choosing FxPro cTrade means opting for an environment where performance meets innovation. We empower you with the tools to navigate global markets confidently and efficiently. Discover how this powerful platform can transform your trading experience.

Key Features of the cTrader Platform on FxPro

Unlock a world of advanced trading possibilities with FxPro cTrader. This platform offers a sophisticated yet intuitive environment, designed for traders who demand precision, speed, and transparency. From direct market access to powerful automation, the ctrader platform equips you with the tools necessary to navigate global financial markets effectively.

One of the standout features is its genuine ECN trading environment. With FxPro, you gain direct access to interbank liquidity, ensuring competitive spreads and lightning-fast execution. This transparency means no dealing desk intervention, allowing you to trade with confidence, knowing your orders are filled at the best available market prices. It’s a core aspect that sets this platform apart for serious traders.

The ctrader platform also shines with its comprehensive charting and analytical tools. Traders can customize charts with a vast array of indicators, drawing tools, and timeframes, enabling in-depth market analysis. Whether you prefer candlestick patterns, bar charts, or line graphs, the flexibility is there to support your unique analytical approach. Spot trends, identify opportunities, and make informed decisions with clarity.

For those seeking to automate their strategies, c algo trading on FxPro is a game-changer. The platform’s cAlgo functionality allows you to develop, test, and deploy custom trading robots and indicators using the C# programming language. This powerful feature supports sophisticated algo trading strategies, enabling continuous market monitoring and automatic execution of trades based on your predefined rules. It means your strategies can operate around the clock, seizing opportunities even when you’re away from your screen.

Beyond these core offerings, here are additional benefits you’ll experience with FxPro cTrader:

- Superior Order Management: Access advanced order types, including market, limit, stop, and trailing stop orders, giving you granular control over your positions.

- Full Market Depth: View the full range of executable prices directly from liquidity providers, offering complete transparency into market supply and demand.

- User-Friendly Interface: Despite its advanced capabilities, the ctrader platform maintains a clean, customizable, and easy-to-navigate interface, suitable for both experienced traders and those new to automated systems.

- Rapid Execution Speeds: Benefit from an infrastructure optimized for speed, ensuring your trades are executed swiftly with minimal latency.

FxPro cTrader is more than just a trading platform; it’s a comprehensive ecosystem built for serious traders who value efficiency, transparency, and advanced functionality. Experience the difference a truly professional trading environment makes.

One-Click Trading Capabilities

In the fast-paced world of financial markets, speed is paramount. Imagine executing your trades with surgical precision, bypassing unnecessary confirmation steps. That’s the undeniable advantage of one-click trading, a feature designed to empower you with ultimate control and rapid response.

The FxPro cTrade platform excels in delivering this critical functionality. With one-click trading enabled on the cTrader platform, you gain the ability to open or close positions almost instantaneously. This means you can react to market movements the very moment they occur, seizing opportunities that others might miss due due to delays. It’s about empowering your decision-making with immediate execution, a hallmark of efficient trading.

This seamless execution is incredibly beneficial across various trading styles. For those engaged in high-frequency strategies or even specific c algo trading systems, where milliseconds can define success, one-click trading becomes indispensable. It helps reduce potential slippage, ensuring your entry and exit points are as close to your intended prices as possible, aligning with the precision expected in ECN trading environments.

Here’s why embracing one-click trading can transform your market engagement:

- Instant Execution: React to news and price changes without hesitation.

- Reduced Slippage: Minimize the difference between your desired price and the actual execution price.

- Streamlined Workflow: Eliminate confirmation dialogues that slow down your process.

- Optimal for Scalping: Essential for strategies that depend on quick entries and exits.

- Enhanced Algo Trading: Provides the necessary speed for automated systems to perform optimally.

Experience the efficiency and precision that one-click trading brings to your FxPro cTrade experience. It’s about putting power in your hands and ensuring you’re always a step ahead.

Depth of Market (DoM) Functionality

Understanding true market dynamics goes beyond just seeing the current bid and ask prices. That’s where Depth of Market (DoM) functionality becomes indispensable. This powerful tool provides a transparent, real-time view of market liquidity, showcasing pending buy and sell orders at various price levels. It’s like peering behind the curtain to see the actual supply and demand at play, giving you a significant edge.

For traders operating in an ECN trading environment, DoM offers unparalleled transparency. You don’t just see a single best price; you observe the full order book, detailing the quantity of lots available at each price increment. This holistic perspective is crucial for making informed decisions, helping you gauge market sentiment and potential price movements with greater accuracy.

Leveraging DoM functionality on the FxPro cTrade platform empowers you with a deeper understanding of market structure. This feature on the ctrader platform is not merely informational; it’s an actionable insight generator. It helps you:

- Spot Liquidity Pools: Identify where significant buy or sell interest lies, indicating potential support or resistance levels.

- Improve Trade Execution: Understand how much volume is available at different prices, allowing for more precise entry and exit strategies, especially for larger orders.

- Gauge Market Sentiment: Observe imbalances in buy versus sell orders to anticipate short-term price direction.

- Enhance Algo Trading Strategies: For those engaged in algo trading or developing custom c algo trading systems, DoM data provides critical input for logic, helping to optimize execution and timing.

Access to such granular data on the FxPro cTrade platform means you are not trading in the dark. You can assess the viability of your trades based on actual market depth, refine your strategies, and react with greater agility. It’s a fundamental tool for serious traders looking to maximize their potential.

Why Choose FxPro for cTrader Trading?

When it comes to serious trading, the combination of a robust platform and a reliable broker is non-negotiable. That’s precisely what you get with FxPro cTrade. We offer an unparalleled environment where advanced technology meets exceptional execution, empowering you to navigate the markets with confidence.

Here’s why traders consistently choose FxPro for their cTrader experience:

- Superior Execution and Transparency: Experience ultra-low latency and tight spreads. Our commitment to transparency means you benefit from genuine ECN trading conditions, ensuring your orders are filled swiftly and at competitive prices. This direct market access is crucial for profitable trading.

- Intuitive and Powerful cTrader Platform: The ctrader platform is renowned for its user-friendly interface and comprehensive features. FxPro enhances this by providing stable connectivity and a seamless trading experience across all devices. Access advanced charting tools, in-depth market analysis, and a customizable workspace tailored to your preferences.

- Unleash Automated Trading with cAlgo: For those who demand precision and automation, FxPro cTrade opens the door to powerful c algo trading strategies. Build, test, and deploy custom indicators and trading robots using C#. Whether you’re a seasoned developer or exploring algo trading for the first time, the capabilities here are extensive.

- Reliable Infrastructure: Our robust infrastructure ensures minimal downtime and maximum stability, so you can focus on your strategy without worrying about technical glitches. This reliability is vital for executing timely trades, especially with fast-paced strategies or when using algo trading.

We understand what modern traders need. FxPro cTrade isn’t just about having access to a great platform; it’s about providing the entire ecosystem that supports your trading journey from start to finish. Our dedication to client success is reflected in every aspect of our service.

| Feature | Benefit to You |

|---|---|

| ECN Trading Model | Fair and transparent pricing, direct market access |

| Advanced Charting | In-depth market analysis for informed decisions |

| c Algo Trading Support | Automate strategies, save time, remove emotion |

| Dedicated Client Support | Prompt assistance whenever you need it |

“With FxPro cTrade, you’re not just getting a platform; you’re gaining a strategic partner committed to your trading success.”

Take control of your trading future. Discover the difference that a truly professional trading environment makes. FxPro cTrade combines innovative technology with a client-focused approach, making it the preferred choice for discerning traders worldwide.

Getting Started with FxPro cTrader: Account Setup

Ready to elevate your trading experience? Diving into the world of FxPro cTrader opens doors to powerful tools and transparent execution. Setting up your account is your crucial first step towards mastering the markets with this cutting-edge platform. We make the process straightforward, ensuring you get started quickly and efficiently.

FxPro cTrader offers a robust environment for both manual and automated trading strategies. Its user-friendly interface combined with advanced functionalities makes it a top choice for traders seeking precision and control.

Why Choose FxPro cTrader?

Many traders flock to the FxPro cTrader platform for its distinctive advantages:

- ECN Trading Environment: Experience genuine ECN trading with deep liquidity and tight spreads, ensuring transparent pricing and rapid order execution.

- Advanced Tools: Access sophisticated charting tools, a wide array of indicators, and customizable layouts to suit your specific trading style.

- Algo Trading Capabilities: Leverage the power of automated strategies. Develop custom indicators and deploy C algo trading robots directly within the platform.

- No Dealing Desk Intervention: Enjoy direct market access without re-quotes or manual intervention, fostering a fair and efficient trading experience.

Your Setup Journey: A Step-by-Step Guide

Setting up your FxPro cTrader account is a seamless process. Follow these simple steps to begin your trading adventure:

- Visit FxPro’s Website: Navigate to the official FxPro website and locate the “Open Account” button.

- Complete the Registration Form: Fill in your personal details accurately. This includes your name, email address, country of residence, and contact information. Choose “cTrader” as your preferred trading platform during this stage.

- Verify Your Identity: To comply with regulatory requirements, you must verify your identity. This typically involves submitting proof of identity and proof of residency documents.

- Fund Your Account: Once your account is verified, deposit funds using one of the many secure funding methods available. An initial deposit allows you to start trading.

- Download and Launch the cTrader Platform: Download the FxPro cTrader platform from the FxPro client area. Install it on your device, log in with your new account credentials, and begin exploring the features.

Documents You Will Need

To ensure a smooth verification process, have these documents ready:

| Document Type | Examples |

|---|---|

| Proof of Identity | Passport, National ID Card, Driver’s License |

| Proof of Residency | Utility Bill (electricity, water, gas), Bank Statement, Tax Document (issued within the last 6 months) |

Embrace the Power of Automation

Beyond manual execution, the FxPro cTrader platform empowers you with robust algo trading tools. Develop custom indicators, automate your strategies, and deploy C algo trading robots directly on the platform. This functionality allows you to execute trades based on predefined rules, removing emotional biases and saving valuable time. Many traders find this aspect of the cTrader platform invaluable for consistent strategy execution.

Ready to Begin?

Setting up your FxPro cTrader account puts you in control. You gain access to a world-class trading environment designed for efficiency and performance. Don’t delay your journey to smarter trading. Start your account setup today and unlock the full potential of the FxPro cTrader platform.

Navigating the cTrader Interface: A User’s Guide

Stepping into the world of online trading demands a platform that’s both powerful and intuitive. The FxPro cTrade experience offers just that: a sophisticated yet remarkably user-friendly environment. cTrader consistently stands out for its clarity and robust feature set. This guide helps you unlock its full potential, ensuring you navigate the ctrader platform with confidence and precision.

You’ll find the cTrader interface organizes essential trading functions logically. Everything you need remains within easy reach, designed for efficiency:

- MarketWatch: Instantly view available instruments, real-time prices, and spreads. Customize your watchlists to focus on your preferred assets.

- Charts: Dive deep into market analysis with powerful, customizable charting tools. Multiple chart types, timeframes, and indicators empower your technical analysis.

- TradeWatch: Monitor your open positions, pending orders, and account history at a glance. Manage your risk effectively from this central hub.

- Indicators & Objects: Access a vast library of technical indicators and drawing tools to enhance your market insights directly on the charts.

Beyond the basic layout, the ctrader platform packs features designed to give you an edge, whether you’re a beginner or a seasoned pro. These tools elevate your trading experience, making complex tasks straightforward.

“Efficiency and precision are the hallmarks of successful trading. cTrader delivers both, making complex tasks straightforward.”

Here’s a quick overview of what makes cTrader special:

| Feature | Benefit |

|---|---|

| Depth of Market (DoM) | View full market depth for accurate pricing and ECN trading conditions. |

| QuickTrade Functionality | Execute trades with a single click directly from the charts or MarketWatch. |

| Advanced Order Types | Utilize sophisticated orders like Stop Loss, Take Profit, and Trailing Stop for better risk management. |

| Multi-Account Management | Seamlessly switch between multiple trading accounts if you manage several portfolios. |

For those looking to automate their strategies, cTrader offers a powerful environment for algo trading. The cAlgo feature lets you develop, test, and run automated trading systems and custom indicators using C#. This is where your trading can truly evolve. You can backtest strategies against historical data, ensuring their viability before deploying them live. This capability dramatically reduces emotional bias and allows for consistent execution of your trading plan.

- Create Custom Bots: Build your own trading robots from scratch or adapt existing ones.

- Develop Unique Indicators: Design indicators tailored to your specific analytical needs.

- Backtesting & Optimization: Test your strategies thoroughly to find optimal parameters.

- One-Click Execution: Deploy your c algo trading strategies with ease.

When you trade with FxPro cTrade, you’re accessing true ECN trading conditions. This means direct market access, tight spreads, and transparent pricing without dealing desk intervention. The cTrader platform inherently supports this environment, giving you a fair and competitive trading experience.

The combination of an intuitive interface, powerful tools, and advanced automation options makes cTrader a top choice. It caters to a wide spectrum of traders, from those just starting out to seasoned professionals employing complex algo trading strategies. Ready to elevate your trading journey? Explore the robust capabilities of FxPro cTrade today and discover a platform designed with your success in mind.

Advanced Charting Tools and Indicators in FxPro cTrader

Mastering the markets demands precision, and that is exactly what you get with the advanced charting capabilities on the FxPro cTrader platform. This robust environment empowers traders with an unparalleled view of market dynamics, turning complex data into actionable insights. You gain a significant edge, whether you are a seasoned professional or just starting your trading journey.

Unleashing Powerful Charting Tools

The FxPro cTrader platform goes beyond basic charts. You command a suite of sophisticated tools designed for deep market analysis. Choose from a vast array of chart types, including standard candlesticks, bars, lines, Renko, and Heikin Ashi, to visualize price action in the way that best suits your strategy. Adjust timeframes instantly, from tick charts to monthly views, ensuring you capture both micro-movements and long-term trends. You also get a rich set of drawing tools:

- Trend Lines: Identify and project market directions with ease.

- Fibonacci Retracements & Extensions: Pinpoint potential support and resistance levels.

- Channels and Shapes: Define price ranges and highlight key patterns.

- Text and Annotation: Personalize your charts with notes and observations.

Each tool offers extensive customization, letting you tailor every aspect to your analytical preferences. This flexibility ensures your charts are not just data displays, but powerful decision-making dashboards.

A Wealth of Indicators at Your Fingertips

Indicators are the heartbeat of technical analysis, and FxPro cTrader delivers an impressive library. You access hundreds of built-in indicators, ready to deploy directly onto your charts. Explore popular options like Moving Averages, MACD, RSI, Bollinger Bands, and Stochastic Oscillators. These tools help you confirm trends, measure momentum, and identify potential reversal points.

But the power does not stop there. The ctrader platform encourages innovation. If you require a unique analytical edge, you can create and integrate your own custom indicators using C#. This seamless integration means your specialized tools become an integral part of your trading environment, enhancing your market perspective.

Driving Strategy with c Algo Trading

The synergy between advanced charting and indicators truly shines when you venture into automated trading. The insights gleaned from detailed chart analysis directly inform your trading algorithms. Whether you are developing complex automated strategies or fine-tuning existing ones, the visual feedback provided by FxPro cTrader is invaluable. You can backtest your strategies, observe how indicators perform under various market conditions, and refine your c algo trading logic.

This deep analytical environment makes it simpler to translate your manual trading ideas into robust, automated systems. You define entry and exit points, risk management parameters, and profit targets with confidence, knowing your analysis is grounded in comprehensive charting data.

The Advantage for Every Trader

Ultimately, these advanced tools empower you to make more informed decisions. For those engaged in ECN trading, precise analysis is paramount for executing strategies effectively. The clarity offered by FxPro cTrader’s charting and indicator suite helps you spot opportunities, manage risk, and validate your trading thesis with greater accuracy. This comprehensive platform supports every trading style, ensuring you always have the analytical firepower you need to navigate the dynamic financial markets.

Automated Trading with cBots on FxPro cTrader

Imagine a world where your trading strategies execute flawlessly, around the clock, without emotional interference. That world is here with automated trading using cBots on the FxPro cTrader platform. This powerful combination empowers you to transform your trading approach, bringing precision and efficiency to the forefront. FxPro cTrade provides a sophisticated environment designed for serious traders looking to leverage the full potential of algorithmic execution.

cBots are custom-built trading robots designed specifically for the cTrader platform. They allow you to automate virtually any trading strategy, from simple entry and exit signals to complex risk management protocols. Think of them as your personal trading assistants, working tirelessly based on predefined rules. This capability for c algo trading means your strategies operate with unwavering discipline, capitalizing on market opportunities even when you are away from your screen.

Automating your trades with cBots offers a multitude of compelling advantages:

- Unwavering Discipline: cBots execute trades based purely on logic, eliminating emotional decisions like fear or greed that often impact human traders.

- 24/7 Market Access: Your strategies can run continuously, monitoring markets and executing trades across different time zones without requiring your constant attention.

- Speed and Efficiency: Algorithms process market data and react to opportunities much faster than any human, ensuring timely execution.

- Extensive Backtesting: You can rigorously test your cBot strategies against historical data, fine-tuning them to optimize performance before deploying them live.

- Diversification: Run multiple cBots simultaneously across different instruments or strategies, diversifying your approach and managing risk more effectively.

The FxPro cTrader platform provides an exceptional ecosystem for developing and deploying these automated solutions. Its user-friendly interface for strategy development, combined with robust backtesting tools, makes it accessible for both experienced developers and those new to algo trading. FxPro’s commitment to delivering superior execution ensures your cBots operate under optimal conditions, often benefiting from deep liquidity and competitive pricing characteristic of ECN trading environments.

Getting started with cBots on FxPro cTrader is straightforward. You can develop your own custom cBots using C# within the cTrader Automate interface, or explore the expansive cTrader community for pre-built robots and shared strategies. FxPro seamlessly integrates these tools, allowing you to focus on strategy development and deployment. This comprehensive support empowers you to redefine your trading experience, moving beyond manual execution to a world of strategic automation.

Developing Your Own cBots

Unlock an entirely new dimension of trading automation by developing your own cBots. These sophisticated algorithmic tools, native to the cTrader platform, empower you to execute trading strategies with unparalleled precision and speed. Imagine a trading assistant that works tirelessly around the clock, adhering strictly to your predefined rules, free from emotion or fatigue.

cBots are essentially trading robots, coded to perform actions based on complex conditions you define. Whether you aim to scalp tiny price movements or manage long-term portfolio diversification, a custom cBot puts you in complete control of your automated trading journey. It is where your strategic vision meets computational power.

- **Strategic Autonomy:** Implement unique strategies without relying on third-party solutions.

- **Precision Execution:** Enter and exit trades at exact moments, minimizing slippage and maximizing opportunities, particularly crucial in fast-moving markets or ECN trading environments.

- **Backtesting & Optimization:** Test your strategies extensively against historical data to refine them for peak performance before live deployment.

- **Emotional Discipline:** Eliminate human error and emotional biases from your trading decisions.

Starting your cBot development journey is more accessible than you might think. cTrader provides a robust integrated development environment (IDE) directly within the platform. You will be using C#, a powerful and versatile programming language, allowing you to craft everything from simple entry/exit rules to intricate risk management systems.

“The future of trading is in your code. Build it.”

Your custom cBot becomes a game-changer, especially for dynamic market conditions. It can analyze vast amounts of data, identify patterns, and react to market events far quicker than any human ever could. This capability is invaluable for engaging in high-frequency scenarios or specific ECN trading strategies where milliseconds make a real difference. For instance, an FxPro cTrade account can provide the optimal environment for your carefully designed algorithms to thrive, offering competitive spreads and rapid execution.

Consider the stark contrast between manual and automated trading:

| Feature | Manual Trading | cBots (Algo Trading) |

|---|---|---|

| **Decision Speed** | Slow (human reaction) | Instant (code execution) |

| **Emotional Impact** | High (fear, greed) | None (logic-driven) |

| **Market Scan** | Limited (human capacity) | Extensive (24/7 analysis) |

| **Backtesting** | Difficult, subjective | Easy, objective, data-driven |

Developing cBots takes you deep into the realm of c algo trading. It is not just about automating existing ideas; it is about formulating new, intricate strategies that can only be executed through precise code. You gain an intimate understanding of market mechanics and strategy performance. The ability to craft your own algo trading solutions gives you a significant edge, letting you tailor your approach to specific market niches or personal risk tolerances.

Embrace the challenge of developing your own cBots. It is a rewarding path that merges analytical thinking with programming prowess, ultimately enhancing your trading capabilities on the cTrader platform.

Accessing the cTrader Automate Community

Ready to elevate your automated trading? The cTrader Automate Community offers a dynamic space where traders just like you connect, collaborate, and conquer the complexities of algorithmic strategies. It’s a vibrant ecosystem built for learning and innovation, perfect for anyone serious about `algo trading`.

As an `FxPro cTrade` user, you gain straightforward access to this powerful network. This community provides a dedicated forum to share your experiences, ask questions, and tap into a wealth of collective knowledge. Whether you are refining an existing bot or just starting your journey into `c algo trading`, you will find unparalleled support here.

Joining the community unlocks a range of benefits:

- Expert Insights: Learn directly from seasoned developers and traders. Discover new approaches to bot development and strategy optimization.

- Code Sharing: Access a library of shared indicators and cBots. Get inspiration or even ready-to-use solutions to jumpstart your projects on the `ctrader platform`.

- Problem Solving: Encounter a bug or a logic puzzle? Post your query and receive constructive feedback from fellow community members.

- Strategy Discussions: Delve into sophisticated trading concepts. Explore how others approach various market conditions, including strategies tailored for `ecn trading` environments.

This active community thrives on shared success. Engage in lively discussions, contribute your own findings, and help others on their path to mastering automated trading. It is a fantastic way to broaden your horizons and keep pace with the evolving world of algorithmic trading. Your next big breakthrough could be just a conversation away.

Order Types and Execution on FxPro cTrader

Understanding how your orders are placed and executed is crucial for successful trading. FxPro cTrader empowers you with a robust set of order types and an efficient execution model, giving you precise control over your trading strategies. This advanced ctrader platform is designed to meet the demands of even the most sophisticated traders, ensuring speed and reliability.Mastering Core Order Types

The FxPro cTrader offers all the essential order types you need to navigate the markets effectively. These foundational tools allow you to specify exactly how and when you want to enter or exit a trade.- Market Orders: Execute your trade instantly at the best available market price. Ideal when speed is your top priority and you need to get into or out of a position without delay.

- Limit Orders: Buy or sell at a specific price or better. A buy limit order will only execute at your set price or lower, while a sell limit order executes at your set price or higher. Use these to secure better entry or exit points.

- Stop Orders: Designed to limit potential losses or lock in profits. A buy stop order triggers when the market reaches your specified price, while a sell stop order does the same on the downside. They become market orders once triggered.

Advanced Order Management for Precision Trading

Beyond the basics, FxPro cTrader provides sophisticated order types that offer even greater flexibility and control, allowing for intricate strategy implementation.For traders seeking an edge, the ctrader platform includes features that help automate risk management and profit-taking:

| Order Type | Description |

|---|---|

| Stop Limit Orders | Combines the features of stop and limit orders. Once your stop price is triggered, a limit order is placed, ensuring your trade executes within a defined price range. |

| Trailing Stop Orders | Automatically adjusts your stop loss level as your trade moves into profit, maintaining a specified distance from the current market price. This helps protect gains without requiring constant manual adjustment. |

| Take Profit Orders | Automatically closes a profitable position once a predefined price level is reached, securing your gains. |

“Effective order management is the backbone of consistent trading. FxPro cTrader provides the tools to execute your vision precisely.”

ECN Execution: Speed and Transparency

One of the standout features of trading with FxPro cTrader is its commitment to superior execution. FxPro operates a Non-Dealing Desk (NDD) model, which includes robust ECN trading capabilities.What does this mean for you?

- True Market Prices: Your orders are matched directly with liquidity providers, resulting in highly competitive spreads and direct market access.

- No Re-quotes: Experience fewer re-quotes, especially during volatile market conditions, leading to smoother and more reliable trade execution.

- Lightning-Fast Execution: Benefit from an average execution speed measured in milliseconds, critical for high-frequency trading and capitalizing on fleeting opportunities.

- Enhanced Transparency: See the true depth of the market with Level II pricing, allowing you to make more informed trading decisions.

Empowering Automated Strategies with cAlgo Trading

For those interested in automating their trading strategies, the FxPro cTrader truly shines. Its integrated cAlgo feature (often referred to as c algo trading) offers a powerful environment for algorithmic trading.With cAlgo, you can:

- Develop custom indicators and trading robots (cBots) using C#.

- Backtest your strategies against historical data to refine performance.

- Optimize parameters to maximize potential returns.

- Deploy your cBots for automated execution, allowing your strategies to work around the clock without manual intervention.

This capability for algo trading provides a significant advantage, particularly for traders who prefer systematic approaches or want to manage multiple strategies concurrently.

Why Choose FxPro cTrader for Your Execution Needs?

FxPro cTrader offers a seamless trading experience, combining advanced order types with top-tier execution. Whether you are manually placing trades or engaging in sophisticated c algo trading, the platform is engineered to support your goals. Its ECN trading environment guarantees transparency and efficiency, giving you peace of mind with every transaction. Join FxPro today and experience the difference precision execution makes.Mobile Trading Experience with FxPro cTrader Apps

Imagine managing your trades, analyzing markets, and executing strategies no matter where you are. The FxPro cTrade mobile apps transform your device into a powerful trading station, bringing unparalleled convenience and capability directly to your fingertips. We understand that in today’s fast-paced world, staying connected to the market is not just an advantage—it’s a necessity.

Gone are the days when you needed to be tethered to a desktop to engage with the financial markets. The FxPro cTrader platform, optimized for mobile, provides a seamless and intuitive experience. You gain instant access to real-time market data, interactive charts, and a full suite of analytical tools. This means you make informed decisions quickly, seizing opportunities as they arise, whether you are on your commute or enjoying a break.

Here’s what makes the FxPro cTrader mobile experience truly stand out:

- Full Functionality on the Go: The mobile app mirrors the robust features of its desktop counterpart. You get comprehensive order types, advanced charting with multiple timeframes, and a wide array of indicators, all beautifully rendered for smaller screens.

- Lightning-Fast Execution: Benefit from deep liquidity and transparent pricing. Your orders process rapidly, essential for dynamic market conditions and effective ecn trading strategies.

- Seamless Integration: Your trading accounts and settings synchronize across all devices. Start an analysis on your tablet and execute the trade moments later on your smartphone without missing a beat.

- Sophisticated Algo Trading Support: For those who leverage automated strategies, the mobile app provides powerful support. Monitor your custom indicators and even manage your automated setups with ease, making c algo trading highly accessible.

- User-Friendly Interface: Navigate markets, open and close positions, and manage risk with a clean, intuitive design. The user experience prioritizes efficiency and clarity, ensuring you execute every move with confidence.

With the FxPro cTrade mobile apps, you command your trading activity from anywhere. This level of flexibility empowers you to react swiftly to market shifts, manage risk effectively, and stay ahead of the curve. Experience the freedom of comprehensive trading, fully optimized for your mobile device, and discover a smarter way to engage with the global markets.

Spreads, Commissions, and Costs on FxPro cTrade

Understanding the costs associated with your trading is fundamental to success. On FxPro cTrade, we believe in transparent pricing, ensuring you know exactly what to expect. This clarity empowers you to manage your strategies effectively, whether you are manually placing trades or employing advanced algo trading systems.

Unpacking Spreads on FxPro cTrade

The spread is the difference between the bid and ask price of a currency pair or other asset. It represents a primary cost of trading. FxPro cTrade is renowned for offering highly competitive spreads, which can fluctuate based on market conditions, liquidity, and the specific instrument you are trading.

Thanks to our robust liquidity providers and ECN trading model, you often find tighter spreads on the ctrader platform. This means lower transaction costs for each trade you open and close.

- Variable Spreads: Most instruments on FxPro cTrade feature variable spreads, adjusting dynamically with market volatility.

- Tighter Entry: Lower spreads mean you start with a smaller negative amount on your trade, improving potential profitability.

Commission Structure for FxPro cTrade Accounts

While spreads are a key cost, some account types on FxPro cTrade, particularly those offering direct market access, also involve commissions. These commissions are typically charged per lot (a standard unit of currency) and are separate from the spread.

Our commission structure on the ctrader platform is straightforward and designed to be highly competitive. It ensures you receive excellent value, especially when combined with the tight spreads on offer. This two-tiered approach of spreads plus commission is common in ECN trading environments, providing true market pricing.

For example, a typical commission might look like this:

| Instrument Type | Commission per Side per Lot |

|---|---|

| Major Forex Pairs | Competitive Rate |

| Minor Forex Pairs | Competitive Rate |

Remember, commissions are usually charged when you open and close a trade (per “side”).

Other Potential Trading Costs

- Swap Rates: If you hold positions overnight, you will incur (or receive) swap charges or credits. These are interest adjustments based on the interest rate differential between the two currencies in a pair.

- Inactivity Fees: While not common for active traders, it’s wise to be aware if any inactivity fees apply to your account over extended periods without trading activity. FxPro aims to keep these policies transparent.

- Currency Conversion Fees: If your trading account is in a different currency than the asset you are trading, a small conversion fee might apply to profit/loss calculations.

Optimizing Costs for Algo Trading Strategies

For traders leveraging c algo trading, understanding and minimizing costs is absolutely crucial. The consistent and transparent pricing model on FxPro cTrade, with its tight spreads and clear commission structure, offers a significant advantage for automated strategies.

When you engage in algo trading, even tiny differences in spreads or commissions can accumulate rapidly across many trades. The efficient pricing environment of the ctrader platform allows your automated systems to operate with greater precision, improving the probability of profitable outcomes by reducing overall transaction impact.

Our platform provides the stable and cost-effective foundation your algorithms need to thrive in dynamic markets. Take control of your trading future by partnering with a broker that prioritizes your success and provides clarity on all costs.

Typical Spreads for Popular Instruments

Understanding spreads is fundamental for any serious trader. It’s the difference between the bid and ask price, essentially your cost to open a position. At FxPro cTrade, we pride ourselves on delivering transparent and highly competitive spreads, a direct benefit of our robust ECN trading environment. This setup connects you directly to liquidity providers, ensuring you receive the best possible market prices.

Our commitment to tight spreads means more of your potential profit stays with you. Whether you actively day trade or manage complex strategies, these costs directly impact your bottom line. We make sure the cTrader platform clearly displays these real-time spreads, empowering you with complete visibility for every trade you place.

Here’s a glimpse at the typical spreads you can expect for some of our most popular instruments:

| Instrument | Typical Spread (Pips) |

|---|---|

| EUR/USD | 0.2 – 0.6 |

| GBP/USD | 0.5 – 1.0 |

| Gold (XAU/USD) | 15 – 30 cents |

| Crude Oil (WTI) | 3 – 6 cents |

| DAX 40 (GER40) | 0.8 – 1.5 points |

These dynamic spreads are indicative and fluctuate based on market conditions, liquidity, and time of day. However, our goal remains consistent: to offer some of the most competitive rates available, especially beneficial for high-frequency traders or those engaged in c algo trading.

Tight spreads are a game-changer for sophisticated trading strategies. For instance, algo trading relies heavily on minimizing transaction costs across numerous trades. With FxPro cTrade, you gain a tangible advantage, optimizing the performance of your automated systems. Our transparent pricing model means you always know your trading costs upfront, making financial planning simpler and more precise.

Commission Structure Explained

Understanding trading costs is crucial for every trader, from beginners to seasoned professionals utilizing sophisticated `algo trading` strategies. At FxPro, we pride ourselves on a transparent and competitive commission structure, especially for our popular `FxPro cTrade` platform. We ensure you always know exactly what you pay, allowing you to manage your trading capital effectively. Our model is designed to offer tighter raw spreads, common in `ecn trading` environments, combined with a clear commission fee. This approach means you benefit from direct market pricing, without hidden markups embedded in the spread. It’s a straightforward system that provides excellent value, particularly for high-volume traders or those executing numerous smaller trades. Here’s a breakdown of how the commission works on the `ctrader platform`:- Commission is typically charged per side (when opening and closing a trade).

- The fee is usually calculated per standard lot (100,000 units of the base currency).

- Rates are highly competitive, designed to support active trading.

For example, a typical commission might look like this:

| Instrument Type | Commission per 1M USD Traded (Round Turn) |

|---|---|

| Major FX Pairs | $45 |

| Minor FX Pairs | $45 – $50 |

| Metals | Competitive Rate |

(Note: Specific rates can vary slightly based on the currency pair or instrument. Always check the official FxPro website for the most current and detailed information on commission fees.)

This clear, volume-based commission, coupled with ultra-tight spreads, empowers you to execute your strategies with confidence. It’s a testament to our commitment to fair and transparent trading conditions, helping you focus on your trading decisions rather than worrying about hidden costs.

Security and Regulation: Trading with FxPro

When you choose a broker, trust and reliability are your top priorities. FxPro understands this deeply, and they have built their operations on a foundation of robust security measures and unwavering regulatory compliance. This commitment ensures a safe and transparent trading environment for every client.

FxPro operates under the vigilant eyes of several top-tier financial regulatory bodies across the globe. These authorities demand the highest standards of conduct, financial stability, and transparency from their licensees. Their rigorous frameworks provide a critical layer of protection for your investments.

- Regulated by the Financial Conduct Authority (FCA) in the United Kingdom.

- Authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC).

- Supervised by the Financial Sector Conduct Authority (FSCA) in South Africa.

- Licensed by the Securities Commission of The Bahamas (SCB).

Protecting your capital is non-negotiable for FxPro. They ensure all client funds are held in segregated bank accounts, completely separate from the company’s operational capital. This means your money remains ring-fenced and secure, even in unforeseen circumstances involving the company. Clients also benefit from investor compensation schemes in relevant jurisdictions, providing an additional layer of security for eligible traders.

Beyond financial segregation, the security of your actual trading experience is paramount. Platforms like the FxPro cTrade and the broader ctrader platform employ advanced encryption technologies. This safeguards your personal data and every transaction you make. Whether you are executing manual trades or engaging in sophisticated c algo trading strategies, your activities remain protected by cutting-edge security protocols. FxPro’s entire infrastructure is built for resilience, ensuring maximum uptime and data integrity.

FxPro champions transparency across its services. Their business model, particularly their ECN trading environment, offers direct market access and highly competitive pricing. This transparency extends to execution, providing you with clear insight into your trades. They operate with a non-dealing desk intervention policy, which ensures fair and swift order execution without conflicts of interest. This approach fosters trust and provides a level playing field for all traders, whether they use basic or advanced algo trading strategies.

“Your financial security and peace of mind are at the core of our operations. We consistently uphold the highest industry standards to protect your investments and personal information.”

Choosing FxPro means partnering with a broker that places your security, regulatory compliance, and peace of mind at the forefront. Their rigorous adherence to international regulatory standards and proactive security measures allow you to focus on developing and executing your trading strategies with complete confidence. You can trade knowing your funds are protected and your data is secure.

Comparing FxPro cTrader to Other Platforms

Navigating the vast landscape of trading platforms can feel overwhelming. Many options promise superior performance, but few truly deliver the comprehensive package advanced traders demand. FxPro cTrader stands out as a formidable contender, offering a distinct edge over many conventional platforms. We examine what makes the FxPro cTrade experience unique and why it appeals to those seeking efficiency and precision.

Unrivaled Execution and ECN Trading

When you choose a trading platform, execution speed and transparency are paramount. FxPro cTrader excels in both areas, providing a true ECN trading environment. This means direct access to deep liquidity pools from top-tier banks, ensuring competitive spreads and minimal slippage, especially during volatile market conditions. This direct market access sets the ctrader platform apart from many broker-driven models that can introduce delays or less favorable pricing.

Key advantages of FxPro cTrader’s execution model include:

- Direct Market Access (DMA): Trade directly with liquidity providers.

- No Dealing Desk Intervention: Enjoy transparent execution without re-quotes.

- Tight Spreads: Benefit from the best available bid/ask prices.

- Fast Order Execution: Millisecond execution for precise entry and exit points.

Advanced Automation with cAlgo Trading

For traders who embrace automation, FxPro cTrader offers powerful tools that go beyond basic scripting. The integrated cAlgo (now known as cTrader Automate) platform empowers you to develop, test, and run your own custom indicators and trading robots using C#. This robust environment facilitates sophisticated algo trading strategies, giving you complete control over your automated systems.

Unlike some platforms with proprietary, less flexible programming languages, c algo trading provides a familiar and powerful environment for developers. This translates into greater innovation and the ability to implement highly complex trading logic, giving automated traders a significant advantage.

User Experience and Charting Superiority

Beyond execution and automation, the FxPro cTrader platform delivers a superior user experience. Its sleek, intuitive interface is designed for clarity and efficiency, allowing traders to focus on analysis and strategy without unnecessary clutter. Charting tools are extensive, offering a vast array of indicators, drawing tools, and customizable timeframes to conduct thorough technical analysis. Many traders find the modern design and responsive nature of FxPro cTrader a welcome refresh compared to older, more cumbersome platforms.

A Quick Comparison

Let’s look at some key differentiators when comparing FxPro cTrader to other popular trading platforms:

| Feature | FxPro cTrader Advantage | Typical Platform Comparison |

|---|---|---|

| Execution | True ECN, deep liquidity, fast execution | Often hybrid or market maker models |

| Automation | C# based cAlgo for advanced bots | Proprietary scripting languages, limited scope |

| Interface | Modern, intuitive, highly customizable | Can feel dated, less user-friendly |

| Transparency | No dealing desk, full market depth | Less transparency, potential re-quotes |

Ultimately, FxPro cTrader provides a compelling suite of features for serious traders. Its combination of direct market access, powerful c algo trading capabilities, and a user-friendly interface positions it as a top-tier choice for those demanding precision, transparency, and control in their trading journey.

Maximizing Your Trading Potential with FxPro cTrade Strategies

Ready to elevate your trading game? Unlocking your full market potential demands powerful tools and smart strategies. FxPro cTrade offers a robust environment built for serious traders seeking precision and efficiency. We empower you to execute sophisticated strategies with confidence, transforming your approach to the financial markets.The core of your success often lies in the platform you choose. The cTrader platform provides an intuitive, user-friendly interface alongside advanced functionalities. Traders appreciate its clear layout and comprehensive charting tools, which are essential for detailed market analysis. You gain access to deep liquidity, transparent pricing, and rapid execution, crucial for effective strategy deployment.

Harnessing the Power of cAlgo Trading for Automation

Imagine executing complex strategies around the clock without constant manual oversight. This is where c algo trading shines. It allows you to develop custom indicators and automated trading robots, known as cBots. These powerful tools execute trades based on predefined rules, eliminating emotional biases and ensuring disciplined execution. Embrace the future of automated trading with powerful c algo trading capabilities, allowing your strategies to work tirelessly for you.Whether you prefer hands-on market interaction or system-driven execution, FxPro cTrade supports both. Manual traders benefit from the platform’s precise order control and real-time data. For those seeking efficiency, automated strategies offer a distinct advantage. Consider the benefits:

| Manual Trading | Automated Trading (cBots) |

|---|---|

| Offers flexibility and human discretion | Ensures consistent execution and discipline |

| Direct market feel and quick adaptability | Removes emotional decision-making |

| Suitable for nuanced, discretionary strategies | Ideal for backtesting and systematic approaches |

The Edge of ECN Trading with FxPro

The underlying ECN trading model at FxPro is a game-changer for strategy execution. It ensures direct market access and competitive spreads. You experience true market conditions, free from dealer intervention, which is vital for strategies relying on tight spreads and swift order fills. This transparent environment supports all trading styles, providing an optimal setting for your chosen strategy, whether manual or automated via algo trading.To truly maximize your potential with FxPro cTrade, consider these strategy development principles:

- Define clear goals and risk parameters before you start.

- Thoroughly backtest any automated system using historical data.

- Adapt your strategies to evolving market conditions and news events.

- Start small and scale up as you gain confidence and proven results.

- Utilize the comprehensive analytical tools available on the cTrader platform to refine your approach.

Why FxPro cTrade Stands Apart

FxPro cTrade provides an exceptional ecosystem for traders at every level. From robust execution to advanced automation via c algo trading, it equips you with everything needed to succeed. Join a community that values innovation and performance. Ready to transform your trading approach? Explore the benefits of FxPro cTrade today and start building your legacy.Customer Support and Resources for FxPro cTrader Users

Navigating the dynamic world of online trading demands robust support. FxPro understands this deeply, providing comprehensive customer service and extensive resources for all FxPro cTrader users. We empower you to trade with confidence, knowing expert help and valuable information are always within reach.

Direct Assistance Channels

When you need immediate help, our dedicated support team stands ready. We offer multiple channels to connect with experienced professionals who understand the ctrader platform inside out.

- Live Chat: Get real-time answers to your questions, perfect for quick troubleshooting or general inquiries. Our chat is accessible directly from our website and the ctrader platform interface.

- Phone Support: Prefer speaking to someone? Our professional support agents are available by phone, ready to provide detailed assistance for any complex issues you might face.

- Email Support: For less urgent matters or when you need to send screenshots or detailed explanations, email is an excellent option. We commit to prompt and thorough responses.

Empowering Self-Service Resources

Many traders prefer to find solutions independently. Our extensive online knowledge base is tailored to help you do just that, covering every aspect of the FxPro cTrade experience.

“Empower yourself with knowledge. Our extensive guides and FAQs ensure you have the answers when you need them most.”

Explore a wealth of information designed for both new and seasoned traders:

| Resource Type | Description |

|---|---|

| FAQ Section | Quick answers to commonly asked questions about account management, deposits, withdrawals, and trading on the ctrader platform. |

| Video Tutorials | Step-by-step video guides illustrate how to use various features of the ctrader platform, from placing trades to customizing charts. |

| Detailed Guides | In-depth articles explain trading concepts, platform functionalities, and advanced strategies, including aspects of ecn trading. |

Specialized Support for Algo Trading

For those engaged in automated strategies, FxPro offers specific resources to support your c algo trading endeavors. We recognize the unique demands of developing and deploying automated systems.

Whether you are building your own cBots or utilizing existing ones, our resources help you optimize your algo trading performance. You can find guides on strategy backtesting, optimization, and deploying cBots directly on the ctrader platform.

Our commitment extends beyond basic technical assistance. We strive to provide an environment where every FxPro cTrader user, regardless of their trading style, feels supported and equipped for success.

Future Developments and Updates for FxPro cTrade

FxPro is committed to delivering a cutting-edge trading experience. We constantly refine our offerings to meet the evolving needs of active traders. The FxPro cTrade platform stands as a testament to this dedication, and exciting developments are always on the horizon. We believe in empowering our clients with powerful tools and unparalleled market access, ensuring the FxPro cTrade experience remains top-tier. We continuously work on enhancing the core functionalities of the ctrader platform, bringing you improvements that directly impact your trading. Expect a series of upgrades focused on speed, reliability, and user interaction. Our goal is to make your trading journey smoother and more efficient.Empowering Algo Trading with cAlgo

For those who leverage automated strategies, the future of c algo trading on FxPro cTrade is bright. We are investing in significant advancements to our algorithmic trading capabilities. These updates aim to provide even greater flexibility and power to develop, test, and deploy your automated systems. Here’s what you can anticipate:- Enhanced Strategy Development: We are streamlining the process of creating and fine-tuning trading algorithms. Look forward to more intuitive tools and comprehensive coding environments.

- Advanced Backtesting Features: Gain deeper insights into your strategies with more robust backtesting options. Understand performance under various market conditions before going live.

- Community Integration: Explore opportunities for sharing and discovering new strategies within a vibrant community of algo trading enthusiasts.

- Optimized Performance: Experience faster execution of your automated orders, crucial for high-frequency strategies and capitalizing on fleeting market opportunities.

Refined Market Access and Execution

The strength of the FxPro cTrade platform lies in its direct market access model, providing true ECN trading conditions. Our ongoing developments further solidify this advantage. We continually work to deepen liquidity pools and optimize our execution technology, aiming for even tighter spreads and minimal slippage.| Area of Improvement | Trader Benefit |

|---|---|

| Liquidity Aggregation | Access to deeper pools of capital, leading to better pricing. |

| Execution Speed | Faster order fills, reducing latency for time-sensitive strategies. |

| Connectivity | More stable and reliable links to global markets. |

Intuitive User Experience and New Tools

“We believe a powerful platform should also be effortless to navigate,” says our Head of Product Development. “Our upcoming updates reflect this philosophy, offering both seasoned professionals and new traders a more intuitive and feature-rich environment.”

We invite you to stay tuned for official announcements regarding these exciting updates. Experience the future of trading with FxPro cTrade – where innovation meets execution excellence.

Frequently Asked Questions

What is FxPro cTrade?

FxPro cTrade is a sophisticated trading platform, leveraging the cTrader environment, designed for serious traders. It offers robust execution, transparent ECN trading conditions, advanced analytical tools, and powerful algorithmic trading capabilities through cBots.

How does FxPro cTrade ensure transparent pricing and execution?

FxPro cTrade operates on an ECN (Electronic Communication Network) trading model with no dealing desk intervention. This provides direct market access to deep liquidity pools, ensuring lightning-fast execution, competitive spreads, and transparent pricing without re-quotes.

Can I automate my trading strategies on FxPro cTrade?

Yes, FxPro cTrade offers robust algorithmic trading capabilities through its cAlgo (cBots) functionality. Traders can develop, backtest, and deploy custom trading robots and indicators using C#, allowing for automated strategy execution around the clock.

What advanced charting tools are available on FxPro cTrader?

The FxPro cTrader platform provides an extensive suite of charting tools including various chart types (candlesticks, bars, Renko, Heikin Ashi), multiple timeframes, and hundreds of built-in technical indicators. Users can also create and integrate their own custom indicators.

How does FxPro ensure the security of client funds?

FxPro prioritizes client security by holding all client funds in segregated bank accounts, separate from the company’s operational capital. They are also regulated by top-tier authorities like the FCA and CySEC, providing investor compensation schemes in relevant jurisdictions and employing advanced encryption for data.